Hey Albany, all you state politicians need to stop talking about doing something and actually do it.

Suspending the state tax on gasoline has been talked about for months, now that prices are worse yet perhaps you could take action.

Our state has the 7th highest tax in the nation and suspending it would give our residents approx. a $.36/gallon break.

Average gas prices hit new all-time record high in Syracuse, Albany, more

Updated: Mar. 07, 2022, 8:13 a.m. | Published: Mar. 07, 2022, 8:12 a.m.

This photo shows non-member gas prices at a Fastrac gas station located at the corner of Route 31 and Route 57 in Clay, N.Y. on Monday, March 7, 2022. Average gas prices in the Syracuse area have hit a new all-time high, breaking the previous record set in 2008. (Geoff Herbert | gherbert)

By Geoff Herbert | gherbert@syracuse.com

Gas prices in several Upstate New York Cities have hit a new all-time record high.

The average price for a gallon of regular fuel in Syracuse hit $4.236 per gallon of regular fuel Monday, according to AAA. That broke the previous highest recorded average of $4.232 in July 2008.

According to Gas Buddy, just eight gas stations in the Syracuse area were still selling regular fuel below $4 as of Sunday, while at least ten were at $4.39. The average price of gas in Syracuse has jumped 48 cents in the past week from $3.748 for regular fuel and nearly $1.50 from a year ago, when it was $2.798.

Average gas prices are also at record highs in Albany, Binghamton and Glens Falls, according to AAA. A gallon of regular gasoline in the Albany-Schenectady-Troy region is currently $4.239, nearly three cents higher than the previous record of $4.210 in 2008.

Gas prices in other cities, including Buffalo, Elmira, Ithaca, Rochester, Watertown and New York City, are near historic highs that similarly haven’t been seen in 14 years. The New York state average is currently $4.261, close to the all-time statewide high of $4.309 set in July 2008.

Nationally, gas prices topped $4 on Sunday for the first time since 2008 as well. Missouri has the lowest gas prices around $3.60, while California has the highest at $5.29.

Gas prices at a Fastrac gas station located at the corner of Route 31 and Route 57 in Clay, N.Y. are seen on Monday, March 7, 2022. Average gas prices in the Syracuse area have hit a new all-time high, breaking the previous record set in 2008. (Geoff Herbert | gherbert@syracuse.com)

Patrick De Haan, head of petroleum analysis for GasBuddy, said Russia’s invasion of Ukraine caused the U.S. to see its second largest jump in average gas prices in the span of a week. Russia is the third largest oil producer in the world, accounting for 8-10% of the global oil supply.

“As Russia’s war on Ukraine continues to evolve and we head into a season where gas prices typically increase, Americans should prepare to pay more for gas than they ever have before,” De Haan told the Associated Press.

Some members of Congress have proposed banning Russian oil imports in the U.S., which could have major global economic repercussions including at the pump. Gas prices were already expected to increase due to higher demand with fewer Covid restrictions and warmer weather, plus refinery transitions to summer gasoline.

Though gas prices in Syracuse are likely to increase in the coming weeks, they’re still lower than 2008 when adjusted for inflation. The previous high of $4.232 per gallon would be $5.52 in 2022, according to the U.S. Inflation Calculator.

Gas prices in 2008 also fell by more than 50% from their highs, reaching an average of $1.75 nationwide by the end of that year.

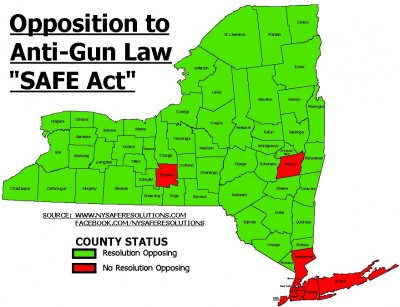

NY SAFE Resolutions

NY SAFE Resolutions

NYS Rifle and Pistol Assoc

NYS Rifle and Pistol Assoc